- The Octopus Value Investing

- Posts

- Theon International - Quantitative Analysis

Theon International - Quantitative Analysis

Financials just made my conviction grow bigger

Last March, I wrote a qualitative analysis of a small Greek manufacturer of night vision devices, Theon International.

This company was an impressive find but the CEO sold around that time a remarkable stake of his at 17.7€ per share. Additionally, it had only been public for a little over a year, so I chose to wait for the FY24 earnings report in May 2025. At that time, tensions between the U.S. and Ukraine were high. European defense stocks rallied when the U.S. announced it would cease all aid to Ukraine in its war against Russia.

Finally, today I took the time to look into the repoted financial by the company so far and ellaborate this second part of the investing study on the company.

DISCLAIMER: This article is not a recommendation to buy or sell any financial instrument, the content is educational and my personal opinion. Each person has to make his own analysis. Any action or decision you take as a result of viewing this article is your sole responsibility.

Podcast Generated from the Write-up

To give you more options to enjoy the write-up I have used Google NotebookLM to generate a podcast of the present write-up that you can listen to while running, during your commute or whenever you like.

The AI-generated podcast does a great job summarizing the article and making the content more accessible. Although it does I great job providing the full picture, I still recommed you to read the full article to get all the details and insights.

Support Independent Analysis

This newsletter will always be FREE! If you’d like to help sustaining it, consider buying me a coffee. With your contribution I will cover any annual costs I might incur and search for alternatives to enhance the experience.

Table of Contents

Update on Qualitative Analysis

Income Statement

Balance sheet

Cash Flow Statement

Capital Allocation

Capital Efficiency

Valuation

Update on Qualitative Analysis

Firstly, I think it is relevant to share updates and further qualitative information which arose during the previous months since the previous write-up.

Incentives

The company IPO took place a little over a year before my previous article and the first remuneration report wasn’t released at that point in time. I assumed that Mr. Hadjiminas large stake ownership (over 75% at that time) ensures alignment with shareholders.

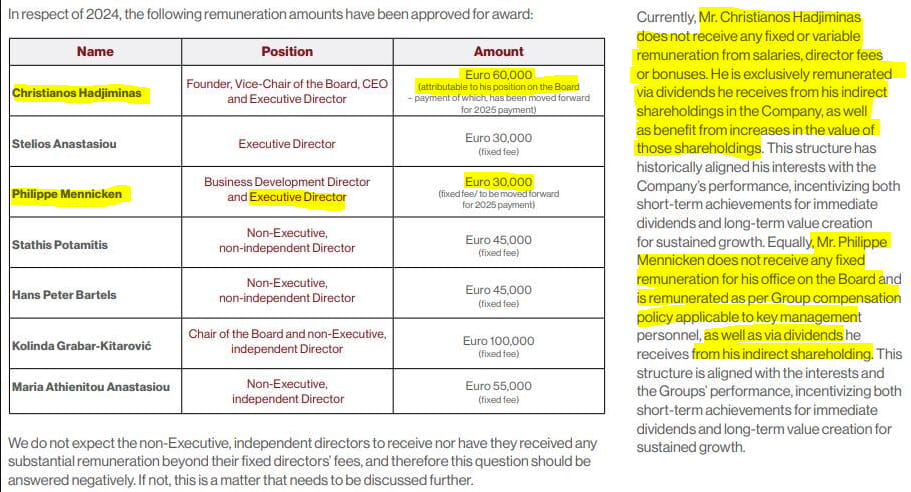

In the FY24 earnings report executive management remuneration was finally disclosed. As it can be observed from figure 1, most executives and non-executives have a base salary comparable to that one of an engineer in Western European countries.

Moreover, CEO receives a base salary for his position at the board while the deputy CEO has a fixed salary of 30,000€ due to his management position. Most of their compensation comes from shares appreciation & dividends (introduces a bias towards capital distribution).

Figure 1: Theon’s remuneration report extract. Source: Theon’s International FY24 earnings report.

Regulatory Barriers

During the Q1 2025 earnings call of Spyrosoft, a Polish digital services consultancy which I am also a shareholder of, management emphasized how lengthy the process to get the certificates, clearances aned completing the public procurement process is. See video below min 30:00 to 31:15. This is what a company “only” doing software expriences, imagine the bureaucratic burden Theon’s competitors will have to overcome if they were new to enter in the defense industry.

This reinforces the idea of the defense sector being a sector with high-barriers of entry to new competitors.

Acquisitions

Theon went on an acquisition spree during the last 18 months using the proceedings of its IPO. This is aligned with outlined expansion plans at IPO and will be further discussed in the capital allocation section.

Income Statement

Revenue

Theon’s revenue during the last 4 years increased from €54.2 million to €352.3 million, showing an explosive growth of 60% YoY during the last five periods.

As the company's revenue base expands, its growth rate is expected to slow down. This trend aligns with management's mid-term guidance, which forecasts a normalization of revenue growth towards the sector average of 11-14%.

Figure 2: Theon revenue evolution during the last 5 years. Source: Own elaboration.

Geographical Sales Distribution

From figure 3, it can be observed that the European market is still by far the most important market of Theon. However, further diversification has been achieved during the last 2 years as European revenue share has been reduced from 86.3% in H1 2023 to 69.6% in H1 2025.

The company is further striving to penetrate other markets, especially the U.S. where despite tariffs not having an impact on defense supplies (maybe we should call them war supplies from now on when talking about the ones going into the U.S.), there is a clear bias towards U.S. designed products.

Figure 3: Semester sales share broken down by region. Source: Own elaboration

Product Segments

Historically, over 90% of the sales have come from night vision devices (NVDs). However, the company expects thermal devices and A.R.M.E.D. (Augmented Reality Modular Ecosystem of Devices) product to step up in the revenue share, constituting at least 20% of the mix by 2026, that will be followed by a major impact of electro-optical devices in 2027.

Theon is putting a lot of emphasis for its future growth on A.R.M.E.D. products. We may end up this year about 10% from digital products or products that are not related to night vision companies. However, next year, we know as a fact that this percentage, we've already announced it's going to be more than 20%, from existing business, but also tenders that we hope to soon announce. And our target is to increase this, and to keep increasing it through the man-portable A.R.M.E.D. products in 2027. But in 2027 we also expect a major impact of the electro-optical platforms.

Hence the product portfolio will look as follow in the coming years:

Night vision devices (NVDs) - historically over 90% of sales.

I. Googles

II. Weapon sights

III. Platform based

Thermal imaging

I. Weapon sights

II. Platform based

A.R.M.E.D. - Internally developed devices which blend night vision with thermal. image pictures.

I. Googles

II. Weapon sights

Electro-optical devices platforms - category added by Kappa Optronics acquisition.

Figure 4: Semester sales share broken down by product category. Source: Own elaboration

Backlog & Orders

After an extraordinary order intake in Q4 2024, soft backlog (defined as the hard backlog plus orders subjected for approval) sits at €622 million while order intake has normalized over the last two quarters. Additionally, €378 million of contractual options provide further room for growth.

According to management, 40% of the backlog is expected to be delivered in 2025, 50% in 2026 and the remaining 10% in the coming years.

Figure 5: Backlog & order intake evolution. Source: Own elaboration

Margins

Theon International has shown stable margins during its expansion.

Average gross margin has ranged between 31% - 35% during the period of scope. As a final developer and assembler, Theon spends a large portion of its revenue as COGS as the items they assemble such as the IITs or their NVDs are expensive items with few suppliers.

However, the company shows great operational execution with an average operating margin during the last five years sitting around 25% and a net margin of 19% net margin.

Figure 6: Theon’s International margins evolution. Source: Own elaboration.

Operating Income

Operating income has grown at an average of 70% per year, outpacing revenue. This demonstrates the company's ability to achieve operating leverage as it scales, a common characteristic of industrial companies.

Figure 7: Theon’s International operating income evolution. Source: Own elaboration.

Breaking down the operating expenses by category, it can be observed how all categories have grown in parallel during the last years except for R&D expenses in 2024 which outpaces sales growth. This aligns with the company’s strategic bet on A.R.M.E.D. platform, an ecosystem of connected devices to software solutions such as Theon’s battery management systems.

Regarding SGA expenses, it should be noted that Theon International mainly supplies to institutional customers such as the Defense ministry of NATO states. Hence, some of its selling expenses such as marketing are limited to very specific forums such as defense and security exhibitions.

It was also highlighted during the call that administrative expenses have stepped up considerably in finance and legal departments due to the required manning to support M&A activity.

Figure 8: Theon’s International operating expenses breakdown. Source: Own elaboration.

Net Income

Net income has grown even faster than sales and operating profit, at an average of 80% every year during the last 5 years.

The P&L statement clearly shows how increased sales drive improved profitability across all line items.

Figure 9: Theon’s International net income evolution. Source: Own elaboration.

Balance Sheet

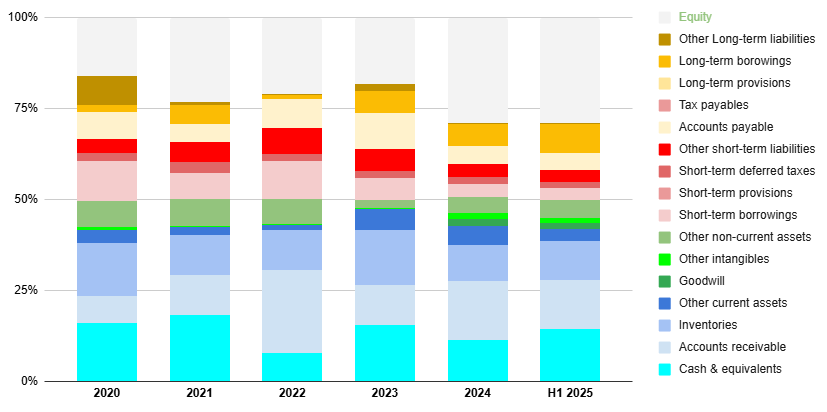

Theon International presented a strong balance sheet at the end of H1 2025. However, since the closure of the first semester of the year the company has executed multiple investments and acquisitions that have shifted it.

Figure 10: Theon International balance sheet evolution. Source: Own elaboration.

Prior to the spree of investments and acquisitions Theon has embarked during 2025, balance sheet ratios were healthy. See table below.

In million € | Theon International at H1 2025 |

|---|---|

Net debt | -29.5 |

Total debt | 92.3 |

Equity | 246.6 |

Total assets | 424.6 |

TTM EBITDA | 100 |

Debt-to-Equity ratio | 0.37 |

Equity-to-Assets ratio | 0.58 |

Total debt/TTM EBITDA | 0.92 |

Net debt/FCF | Negative TTM FCF & net cash position |

Interest coverage ratio | 31.4 |

Moreover, it should be highlighted that almost €21 million out of €26.6 million in short term debt obligations are personally guaranteed by Christianos Hadjiminas. That is skin in the game.

Cash Flow Statement

FCF Generation

Cash generation has been lagging due to the large investments in NWC that the company has undertaken in 2022 and 2024. Excluding those two periods, cash conversion has ranged between 60 - 70%.

CapEx has grown in line with sales during the period of scope.

Figure 11: Theon’s cash generation metrics evolution. Source: Own elaboration.

Working Capital

Looking at Theon's working capital, the cash conversion cycle has worsened over the past five years. This is primarily due to the company's strategic focus on building up inventory to meet an anticipated surge in customer demand, which has materialized. However, the main driver of the cash conversion cycle's deterioration from 2023 to 2024 was a tripling of accounts receivable, indicating Theon is facing challenges in collecting payments from its customers.

I expect the cash conversion cycle trend to revert in the coming years and lead to accretive cash generation. Its evolution should be carefully followed.

Figure 12: Working capital evolution of Theon International. Source: Own elaboration.

Capital Allocation

M&A

When IPOd, management had a clear ambition to deploy the proceeds from the equity into bolt-in acquisitions to strengthen the company as well as other growth initiatives. The company wasn’t new to this operating model as they already followed this same playbook when they were private (e.g. Hensholdt acquisition in June 2022).

Let’s have a recap of the acquisitions Theon has done over the last 18 months:

I. Harder Digital majority stake acquisition

Harder Digital is a German company specializing in the production of Image Intensifier Tubes (IITs), essential components in NVDs. The €35 million investment (for 60% of Harder Digital) is structured to serve multiple purposes. The majority of the funds are earmarked for upgrading Harder Digital’s production facilities with a focus on expanding capacity for third-generation IIT manufacturing lines.

Harder Digital’s acquisition gives Theon access to advanced Image Intensifier Tubes. While U.S. manufactured IITs lag behind technologically, they also face export restrictions. Hence this acquisition + capacity expansion in combination with long-term supply agreements with Exosens ensures Theon’s access to latest generation IIT’s.

Harder Digital targets €17 million sales with 10% EBITDA in 2024, and expects tripling sales with mid-twenties EBITDA margin by 2028.

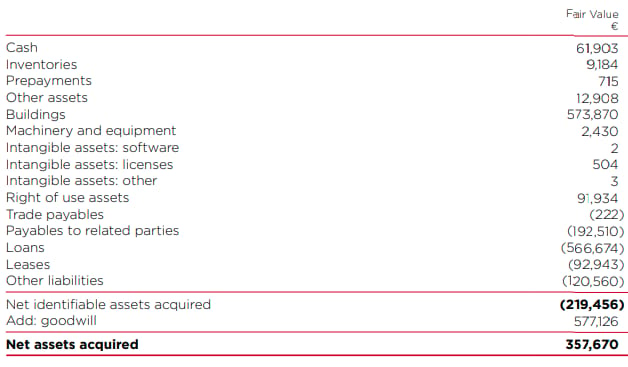

II. Focus Optech acquisition

In January 2025, Theon acquired Focus Optech, a small South Korean firm specializing in precision optical components, for €357,670 (100k in cash and remaining as a loan transferred to consideration).

Based on the size of Focus Optech and its reported balance sheet by Theon, it seems this has been an opportunistic acquisition of a company in a financial distressed situation to set foot in the Asia-Pacific region.

Figure 13: Focus Optech balance sheet summary. Source: H1 2025 earnings report, page 40.

III. Kappa Optronics acquisition

Kappa, a German specialist in aviation and land optronics, offers solutions for defense mobility and autonomous machines on the ground and in the air. This bolt-on acquisition immediately positions Theon International as a direct supplier to Airbus. Kappa Optronics' existing contributions include supplying cameras for the Eurodrone program and the vision system for in-flight refueling.

Theon is funding the $69 million acquisition with a mix of cash and debt. Kappa's fiscal year 2025 financial projections are strong, with expected revenue of $37 million and $8 million in EBITDA. Theon's management has also indicated that after synergies are realized, Kappa's operating margins are expected to quickly converge with Theon's.

Figure 14: Kappa Optronics commercial banner for Singapore airshow. Source: www.kappa-optronics.com

IV. Andres Industries AG minority stake acquisition

In July 2025, Theon acquired a 10% strategic equity stake in Andres Industries AG through a 1.1 million share capital increase, with options to increase its stake up to 24.99% within two years for a total consideration of EUR 4.5 million. This acquistion will reinforce their collaboration in the thermal clip-on offering.

V. Partnership with Kopin Corporation

In August, under its "Theon Next Initiative", Theon announced its partnership with Kopin Corp., a leading U.S. defense specialist in micro-displays and subsystems. Theon's $15 million investment will establish a new European joint venture to co-develop augmented reality-enabled systems and manufacture microLED displays.

This partnership is a pivotal move for Theon's U.S. strategy. While it provides access to Kopin's Scottish facility (49% acquired through a $8 million capital increase), which is a major step into the UK, the agreement’s most significant aspect is the establishment of Theon’s first fully owned U.S. manufacturing facility in Reston, Virginia that will be dedicated to US AR activities. Unlike its previous co-owned facilities with EOTech and Elbit Systems, this new site gives Theon an independent operational base. This is crucial for Theon's long-term growth, as Kopin's work on several advanced U.S. armed forces programs could provide a key competitive advantage.

VI. Varjo Technologies minority stake acquisition

Also in August 2025, Theon announced the acquisition of a minority stake in the Finnish firm Varjo Technologies, specialized in VR/XR headsets and software. This investment aims to support “Theon Next Initiative” and consist in €5 million convertible loan plus additional €5 million under the same terms.

In total, Theon has deployed €125.5 million over the last year with additional options to deploy another €9.5 million in some of the deals described above.

The company also mentioned during the last earnings call that they are looking into further acquisitions in markets that will support their geographical expansion:

We will invest a lot in the U.S. That's why we expect the next two or three acquisitions, small or larger ones, to be in exactly those countries that strengthen our geographical and market penetration, like for instance Finland and the U.S.

CapEx

Theon has spent €25 million in CapEx since going public in 2023 with 40% of that amount being invested over the last 12 months.

Most of that CapEx has been dedicated to improve the manufacturing facilities including:

Greece HQ and manufacturing facility expansion.

Harder Digital production facility enhancement (part of acquisition deal).

Latvia manufacturing expansion.

In July, Theon announced the establishment of a new 6,400-square-meter facility in Latvia to manufacture Multi Channel Plates, a critical component in night vision tubes.

Establishment of Theon Belgium subsidiary.

In July 2025, Theon announced the creation of its new subsidiary, Theon Belgium, and the establishment of a production facility in Zaventem, nearby NATO HQ. The company's goal is to begin production at this new facility in the fourth quarter of 2025.

Buybacks

On the 1st of September, the company announced the initiation of its share buyback programme after obtaining the relevant authorizations from Cyprus Securities and Exchange Commission.

The buyback programme was approved in June during the annual General Meeting, targeting the repurchase of 1.400.000 shares. Theon International currently has 70M shares outstanding. Hence, the buyback programme aims to reduce the company’s share count by 2%.

Considering the share price at the time of approval was above 30€ per share, I estimate that the company is targeting to dedicate between €33M and €45M on the buyback programme during the coming year.

Dividends

The company pays a dividend. They are committed for a 30-40% payout ratio.

During 2025, they paid a dividend of 0,34 EUR per share, which equals a dividend yield of approximately 1.2% at current share price.

Figure 15: Theon’s dividend evolution. Source: Own elaboration.

Capital Efficiency

Theon's financial returns are exceptional, with a reported ROIC consistently exceeding 15% and a company-wide ROCE (including goodwill) of over 30%. This high ROCE, however, may become a less accurate measure in the short term. Due to recent acquisitions, the company will likely shift its focus to a business ROCE—a metric that temporarily excludes goodwill. This will provide a clearer view of returns from core business activities and the successful integration of newly acquired assets.

Figure 16: Theon’s capital returns metrics. Source: Own elaboration.

Valuation

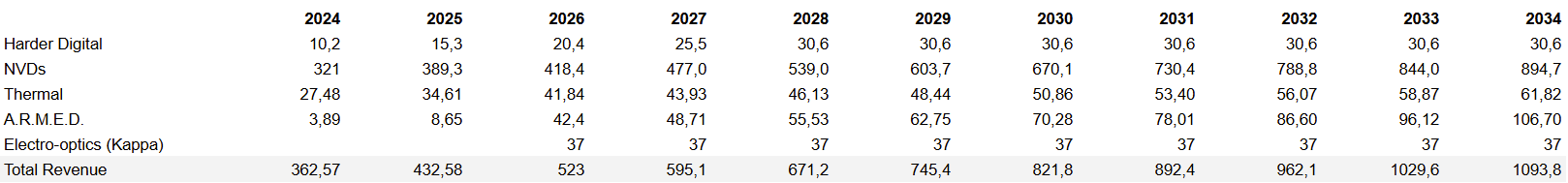

Revenue Projection

Revenue has been broken down into each of the product lines and projected using the following assumptions:

NVDs

Expected to represent 90% and 80% of revenue in FY25 and FY26, respectively.

From there on, NVDs growth rate will slide down from the upper end of NVDs market growth rate towards global defense budgets growth of 5% CAGR.

Thermal

Expected to represent 8% of sales in FY25

Less technological advanced segment. Expected to grow during the next decade at global defense budgets growth of 5% CAGR.

A.R.M.E.D

For FY26, this segment's sales are calculated as 20% of total sales less the thermal segment's expected sales, since the two segments combined will make up 20% of sales that year.

After FY26, the segment will follow the same growth path as NVDs, with an additional 2.0% annual growth to reflect management's guidance that it will outpace NVDs.

Electro-optics (Kappa Optronics products)

Conservative assumption that electro-optronics category will not grow, staying flat at €37 million FY25 estimated sales of Kappa Optronics due to lack of information about this new segment.

Figure 17: Theon’s sales projections over the next decade as per outlined assumptions. Source: Own elaboration

Note: The FY25 sales projection is based on H1 2025 sales plus 40% of the soft backlog, as guided by management. From this, each product category's sales were calculated.

DCF model

Once revenue has been projected, I built the DCF model based on the following assumptions:

EBIT margin to decrease in the coming years while Theon integrates and realizes synergies from acquired companies. EBIT margin will later return to 25% (observed average over the last 5 years).

CAPEX peaking this year at 2025 as some production sites are expected to be finalized in the coming months (Harder Digital improvement and Belgium production site). The CAPEX-to-Sales ratio will come down to 3.0% in the long-term.

D&A increased from current levels at 1% of sales, up to 2.5% in ten years.

The company has a mid-term target of 35%. Let’s consider the worst case and assume they will not be able to improve their working capital management once the hypergrowth stage comes to an end and Harder Digital acquisition is fully integrated.

Figure 18: Theon’s DCF model. Source: Own elaboration

Note: Above model implies returns on invested capital (ROIC) ranging 40-50% for the coming decade. This will not reflect the real business returns as the company is investing in the form of R&D expenses and also will continue doing acquisitions (at least in the coming months as per H1 2025 management comments during the earnings call).

Based on the above model, I get an estimated share fair value of 33,14 euros per share on the above base case using conservative assumptions. Return from current share price will be 14.0% CAGR plus a dividend yield of 1.22%.

Figure 19: Theon’s DCF model inputs & outputs. Source: Own elaboration

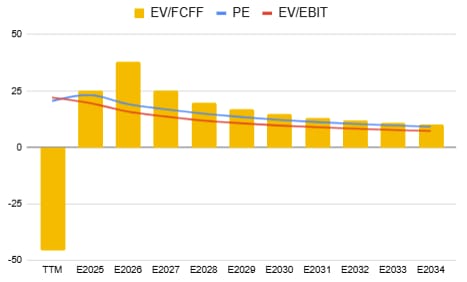

Valuation ratios

Theon’s project ratios show how if the company is able to hold its current trajectory for a couple of years the price paid would be within market averages.

Figure 20: Theon valuation ratios projection. Source: Own elaboration.

Moreover, Theon is usually one of the most undervalued stocks among its peers group (L3Harris, Exosens, Teledyne, Elbit Systems & Hensoldt AG) when making a comparison based on their trailing and forward valuation ratios.

Conclusion

After reviewing the financials and observing how Theon International has executed over the last 6 months my conviction on the company has just grown bigger.

However, a few unknowns make me cautious: we don't have the details on how acquisitions will be funded or what their full financial impact will be. Additionally, it's unclear if bolt-on acquisitions will become a key, recurrent part of the reinvestment plan.

Moreover, while we now understand the management's remuneration policy, it's unclear if the founders and the deputy CEO will prioritize cash distributions over reinvesting in the business.

Because of these uncertainties, I need a sufficient margin of safety. Hence I would like to have a 30% margin of safety so I would consider adding the company to my portfolio if stock price reaches a level around 23.2€ per share.

Hope you enjoyed this quantitative analysis of Theon International (I finally made it! 💪) .

If you found today's insights helpful, please share them with friends or colleagues via social media or email.

Stay Always Tuned!

Subscribe now and join a community of savvy investors. Receive the latest insights directly in your inbox each week, ensuring you never miss a valuable opportunity.

Reply