- The Octopus Value Investing

- Posts

- Pandora A/S - H1 2025 Earnings Review

Pandora A/S - H1 2025 Earnings Review

The Stocks Plunging While the Company is Meeting the FY25 Guidance

Pandora published Friday 15th of August its H1 2025 results and the stock dropped in the same day an astonishing -18%. This is the largest one-day drop since I have been covering the stock hence this earnings review is more critical than ever to understand what is going on.

DISCLAIMER: This article is not a recommendation to buy or sell any financial instrument, the content is educational and my personal opinion. Each person has to make his own analysis. Any action or decision you take as a result of viewing this article is your sole responsibility.

Podcast Generated from the Write-up

To give you more options to enjoy the write-up I have used Google NotebookLM to generate a podcast of the present write-up that you can listen to while running, during your commute or whenever you like.

The AI-generated podcast does a great job summarizing the article and making the content more accessible. However, if you really want to get a detailed overview I strongly recommend you to read the full article.

Support Independent Analysis

This newsletter will always be FREE! If you’d like to help sustain it, consider buying me a coffee. With your contribution I will cover any annual costs I might incur and search for alternatives to enhance the experience.

Executive Summary

Revenue Growth: Revenue grew by +6.0% vs H1 2024 (8% at constant exchange rate), with strong contributions from the USA and Rest of Pandora.

Gross Margin: 79.3% in Q2 2025 (-170bps YoY) was caused by commodities (silver and gold) whose prices keep increasing in these environment full of uncertainty.

Confirmed impact of tariffs: 19% tariff on good imported from Thailand.

Strong EPS growth during Q2 2025 heavily impacted by FX headwinds: from+18.0% to 6.0%.

Unchanged 2025 Outlook and EBIT margin 2026 target lowered when accounting for tariffs impact.

Income Statement

Revenue

After reporting a +16% organic growth (+9% LFL growth) back in H1 2024, Pandora managed to organically grow +7% in H1 2025 (+4% LFL), reaching DKK 14,421 million in sales.

Like-for-like (LFL) sales grew ”just” +3% year-over-year, and together with a +5% contribution from network expansion. LFL growth was negatively impacted by Easter falling in Q2 2025 vs Q1 2024, which according to my calculation could have dragged LFL sales 1%-1.5%.

Figure 1: Pandora quarterly sales split by contributor. Source: Own elaboration.

Due to understocking issues in some markets during the June and July End of Sales season, the company experienced a decrease in like-for-like (LFL) sales compared to the previous year. Management noted that this period was particularly important for sales conversion due to the weak macroeconomic environment.

Figure 2: Pandora’s Q2 2025 growth composition vs Q2 2024. Source: Q2 2025 report, page 11

Gross margin improved by 10 basis points during the first half of 2025 vs H1 2024, 79.9% vs 79.8%. However, Q2 2025 gross margin was heavily impacted from commodities, FX & tariffs headwinds. Reported gross margin in Q2 2025 was 79.3% vs 80.2% in Q2 2024.

Despite the gross margin decrease during the quarter, Pandora has been reporting during the last two years record high gross margins, partly because of silver price lagging so I consider the current drop a normalization of those margins as commodities prices rise.

Pandora has hedged 70-75% of the 2026 P&L exposure for silver and gold combined at a price of around USD 31/oz. At the current silver price (end July 2025) of around USD 36, the overall average silver price in 2026 would be around USD 32.4, including the 25-30% unhedged exposure. Linked to this, the additional margin impact in 2027 from commodities and foreign exchange is estimated at around -110bp vs 2026 due to the fact no hedging is in place for 2027 at this point in time.

Price increases mitigated gross margin deterioration by +60 bps and Pandora implemented another low single digit further price increase in August 2025. Moreover, management highlighted during the earnings call that higher uplift on the gross margin would be possible if they manage to repurpose larger diamonds now that they have shifted focus to smaller ones.

Geographical Revenue Distribution

Starting with Pandora’s largest market, sales in the USA increased by +12% with an outstanding +8% LFL. The USA market represented 33.6% of sales of the company during Q2 2025. Pandora's constant exchange rate sales in the US grew by 14% during the first half of 2025. This growth is nearly three times the 5% gain of the overall US jewelry market reported by jewelry trends analytics company Tenoris, indicating that Pandora is gaining market share. The company currently has a 2% market share vs 4% of the largest market player.

Moreover, Canada´s performance (top 10 market of Pandora, is in line with the USA, showing strong momentum in North America.

The four separately disclosed European markets performance was awful. Except from Germany which is coming from a previous year of hyper growth (+65% sales growth in Q2 2024), the high single digit LFL sales decline of the UK, Italy and France just shows permanent challenges on those markets.

Despite the troubleshooting initiatives initiated earlier this year Italy shows no improvement so far (-8% LFL). France shows similar trend (-7% LFL) and the company is conducting a series of initiatives to “detox the brand”.

After reporting a +2% LFL during Q1 2025, the UK performance in Q2 was quite disappointing posting -9% LFL sales growth. The company attributed the weaker performance to temporary issues, such as the previously mentioned End of Sales stock problems, which do not reflect the underlying business trend. The next few quarters will be crucial in determining whether the sales trend in the country is positive.

Outside Europe, Australia is showing positive sales growth for the 2nd consecutive quarter. It delivered LFL growth of +7% in Q2 2025.

China’s situation shows no improvement for another quarter, with LFL sales down -15% in the quarter. Apart from brand perception, the macro is tough in the country. The company announced that stores closure during the year will be around 100 from previous 50 announced, having closed 22 concept stores so far this year. At current levels the decline is inmaterial to the overall business as China sales represent less than 1% of sales.

The Rest of Pandora segment reported robust LFL growth of +6% in Q2 2025. Growth remains broad-based, with several markets, including Spain, Canada, Poland, Portugal, the Netherlands, Romania, Hungary and the Nordics. Negative point in this geography was the LFL reported in Mexico.

Figure 3: Sales distribution by geography. Source: Pandora H1 2025 earnins report, page 13.

Product Revenue Distribution

Sales growth trends among the different product lines remains unchanged, with LFL growth of 2% in the “Core” segment and a strong 8% LFL increase in the “Fuel for More” considering the tough comps. from H1 2024. Remember, management attributed the rebound in collaborations to well-received Disney Princess Rings collection after a weak 2024 in the segment as well as Collabs being a product segment in which customers are more willing to accept price raises.

Moreover, new releases are year-end loaded with the release of Talisman (diamonds) and Minis (charms) during Q3 2025 which should boost both segments sales, which slightly lagged behind compared to Collabs or ESSENCE.

Figure 4: H1 2025 quarterly sales by product. Source: H1 2025 report, page 7.

Network Development & Performance

Figure 5: Pandora’s points of sale development. Source: H1 2025 report, page 14.

In total, Pandora added 256 stores to its own network compared to Q2 2024 As shown in Figure 5, Pandora directly operates 2,788 points of sale, accounting for 40.5% of its global retail network. During Q2 2025, franchise operated points of sale outpaced Pandora´s own concept stores opening, which is remarkable considering Pandora is trying to expand its owned retail network.

Regarding own stores opening, it should be noted that this trend +50 stores closures were announced in China but net stores opening range was reduced just by -25. Hence, stores opening in other geographies are accelerating.

Moreover, the transformation of Pandora’s online platform is complete and its roll-out in different geographies started during Q1 2025. This (and Easter stores closure) could explain the growth being predominantly driven by online which saw 7% LFL growth in Q2 2025, while Pandora’s own physical network delivered +2% LFL in Q2 2025

Operating Income

In Q2 2025, Pandora's EBIT margin decreased year-over-year by 160 basis points to 18.2%. Foreign exchange rates alone accounted for a 120 basis point drag, with an additional 30 basis point impact from US import tariffs. The company expects these headwinds to intensify, projecting a total full-year impact of 280 basis points.

While reported EBIT declined by 4%, it grew by 6% when measured at a constant foreign exchange rate, with the margin at 19.4%.

Operating expenses rose +9% at a constant exchange rate compared to the same quarter in the previous year, mainly due to the expansion of the store network. Sales and distribution expenses increased by +11%, reflecting the addition of 276 new stores, which contributed over DKK 200 million in additional operating expenses. Marketing and administrative expenses also increased by +4% and +10%, respectively, at a constant exchange rate.

The relatively slower growth in marketing expenses, compared to other operating costs, is not attributed to the ongoing cost control program (Project Silverstone). Instead, it appears to be a strategic decision to phase marketing spend toward the second half of the year to support a significant number of upcoming new product releases.

Figure 6: EBIT margin development vs H1 2024. Source: Pandora’s H1 2025 report, page 15.

Net Income

Net income for the period reached DKK 1,904 million in H1 2025, reflecting a +7.9% year-over-year increase. Finance costs declined -4.3% vs H1 2024, while income tax expenses declined compared to the previous year, supported by a new tax agreement between Denmark and Australia for the 2022–2024 period. This agreement resulted in a one-off tax benefit of DKK 44 million. Adjusting for this non-recurring item, normalized net income grew by +4.6% YoY, dragged by FX impact.

The EPS grew +6.2%, from 9.7 DKK per share in Q2 2024 to 10.3 DKK per share. Adjusting for FX impacts, EPS growth would have been 18% YoY, reflecting the positive impact of shares repurchases are having on earnings per share growth.

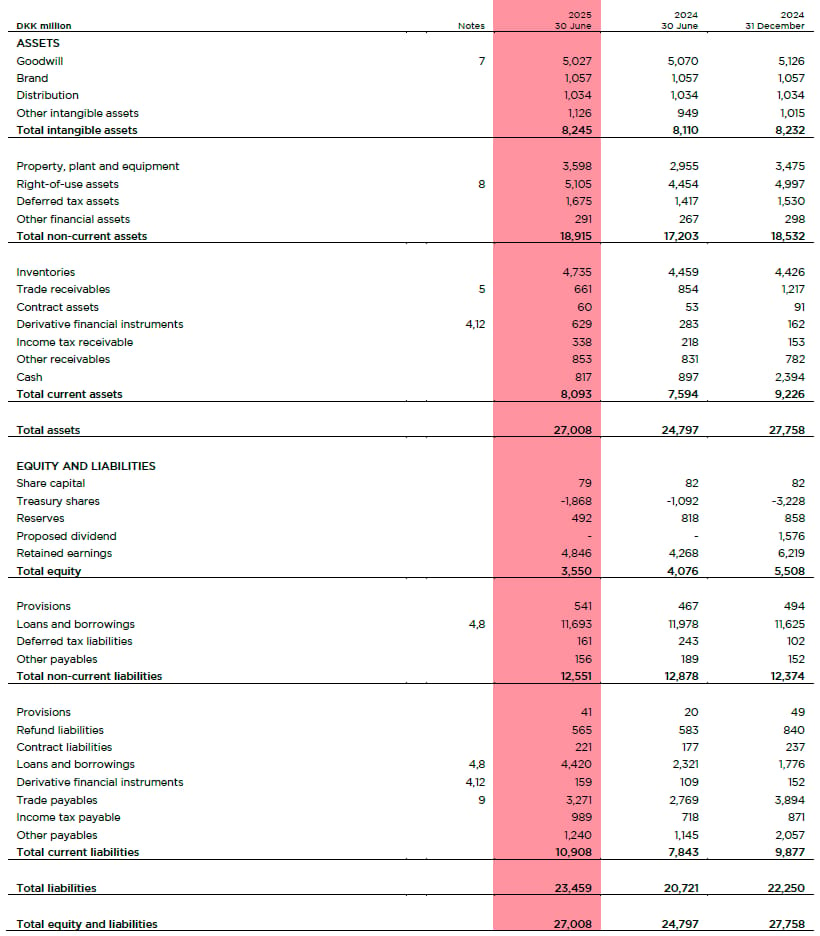

Balance Sheet

No major changes to comment on.

Figure 7: Pandora’s balance sheet. Source: Q1 2025 report, page 29.

Cash Flow Statement

Capital allocation

CapEx & acquisitions

Pandora's capital expenditures included DKK 398 million for the purchase of property, plant, and equipment (PPE), an increase of 25.6% year-over-year. Excluding the purchase of intangibles, DKK 182 million was spent on acquisitions. This represents a substantial increase of 271% compared to the previous year. We can see a booming in acquisition expenses for the second quarter in a row.

Working capital

NWC was 4.7% of Q2 2025 revenue, down from 6.0% during Q2.

Shares repurchase

DKK 1,898 million were used to repurchase stock vs DKK1,867 million last year. Additional DKK 2,133 million available for repurchases until end of January 2026.

Moreover, the company didn’t significantly accelerate the share buybacks during the market’s April dip. Due to the high-level of uncertainty that could have impacted Pandora I think it was a conservative approach that hindsight seems unjustified.

Dividends

DKK 1,567 million were paid in dividends, +6.5% vs Q1 2024.

FCF Generation

In Q2 2025, Pandora reported Operating Cash Flow (OCF) of DKK 1388 million, down -14.6% from DKK 1626 million in Q2 2024. This negative performance was primarily driven by lower profitability, higher finance costs and worsening of working capital.

Reported Free Cash Flow (FCF) standing was DKK 955 million, down -23.9% compared to the previous year. Lower profitability plus higher investments (CapEx peaking due to Vietnam facility construction as it enters its last year of construction) as well as an extraordinary cash conversion in Q2 2024 led to the company almost doubling the amount used from loans & borrowings for financing its activities.

Risks

Before directly jumping into the earnings call with management let’s provide an overview of the main two risks the company currently faces:

Raw materials prices

Pandora is exposed to the commodity prices of silver and gold, raw materials it uses to manufacture its jewelry. The company phases raw materials headwinds as its 2026 EBIT targets were set with a silver price of 23.6$/oz. However, the current silver price will exceed 35$/oz.

In early April 2025, Pandora took advantage of commodity market volatility to increase its hedging of silver exposure for the 2026 Profit & Loss (P&L). As a result, the company has now hedged approximately 70%-75% of its projected silver and gold requirements impacting the 2026 P&L.

2027 hedging will start earliest in 2026 as hedging is an activity done from one year to the next one.

Figure 9: Pandora’s commodities hedging overview. Source: H1 2025 report, page 39.

USA tariffs

Background: Pandora manufactures the majority of its jewelry in Thailand, while also building a second facility in Vietnam, and sources raw materials from China. Recent US trade policy announcements after agreements signed established the tariff level on imports from Thailand at 19% while China’s ones were placed at 54% for China.

The quantified impact by Pandora now that tariffs have been agreed is DKK 50 million lower than anticipated in the best case scenario presented during Q1 2025 while the impact on 2026 while dragging operating margin -120 bps as explained earlier on.

Figure 10: Pandora’s tariffs case scenario analysis. Source: Q1 2025 report, pages 8 and 9.

Management Call & Guidance

Management Call

From the call I like how management acknowledged the existence of problems in some geographies as well as the briefing they provided in about the remediations being implemented:

I think what we mentioned in the past that maybe they became a little bit too, let's call it, say, anglophied, that's now being addressed. But what's also important is the comment I made on adding culturally relevant talent. So let's say there's going to be a stream of communication that's done by, we can call them local key opinion leaders, be the brand ambassadors, ambassadors, influencers (…) So that's probably a layer that we're going to strengthen. That also comes on the learning of our Spanish business, which has been growing, let's say, double digit for years now.

So in addition to the global campaign, they've overlaid this with local talent.

Moreover, I really liked how the long-term thinking arose along the lines during the call. Here there are two different examples, firstly answering about price hikes to protect the margin and, secondly, on using alternative materials:

I mean, I think the answer is relatively simple. The brand's reason to be is to offer affordable jewelry. So, we will obviously protect margins, but not at the expense of consumers still thinking that Pandora is a good offer. (…)

So, we're not going to kind of die on the sword on margins if we have to give up the position of the brand. That would be ludicrous.

So a big question we, of course, had to ask ourselves is in case we move to alternative materials, what's the consumer reaction going to be to that from an overall brand perception standpoint? So because it's equally, I can knock out stainless steel jewelry if I want to, but what I need to understand is what does that do to people's perception of the brand.

(…) So this is not just purely management conversation because it has long term implications or could have long term implications.

Finally, the management provided some updates about the expansion into the major APAC markets such as the new APAC HQ being placed in Singapore or the good performance observed in Japan.

There's quite a number of big markets out there, mostly operated from partners. And so how far can we take that over the next decade, just to say something.

But it's some of the things one of the things that we are looking into and will come to the agenda on the next CMD.

2025 Outlook

FY25 guidance has been confirmed, accounting for the additional -20bps due to negative FX impact. EBIT margin remains unchanged from Q1 2025, and the company noted how its deterioration will be remarkably noticeable in Q3 2025 due to tariffs timing.

Figure 11: Pandora’s updated 2025 guidance. Source: Q2 2025 report, page 20.

Regarding 2026 targets, since they were announced at the 2023 Capital Markets Day (CMD), the company's forecast has been hit by a significant -500 basis points of external headwinds. This is a result of a 380 basis point headwind from commodity and foreign exchange rates, plus an additional 120 basis points from newly announced tariffs.

Pandora lowered the 2024 EBIT target to “at least 24%”, considering already implemented countermeasures while waiting to identify and implement more.

Closing Remarks

Overall, I think Pandora again met the expectations.

On the one hand, USA and Rest of Pandora are the growth engines of the group while, at the same time, China’s place has been taken by Germany and stagnant sales have been observed in saturated markets (Pandora has high single digit or double single digit market share): France, Italy, Australia and UK. As it can be observed from figure 12, it isn’t new that some geography´s performance is lagging behind group’s performance. However, I believe the market is afraid any of those majors might develop in a similar way to China now that headwinds are present.

Figure 12: Pandora´s sales evolution by geography since 2019. Source: Own elaboration.

Moreover, the company is successfully diversifying from bracelets and charms by successfully introducing new collections that compliment their assortment. Network expansion also is developing as expected while the company effectively creates shareholder value by repurchasing its own stock with the excess cash not invested in the business.

All headwinds the company is experiencing are being experienced by its competitors so there is nothing fundamentally broken on the business. In fact, as management highlighted, Pandora´s global reach and best in class margins allows them to be the better prepared player in the affordable luxury segment.

Well, on top of that, of course, we have silver and gold that's been going up. So so those are kind of two headwinds that everybody is dealing with. Now if I'm guessing a man here, we will see a general price rise for the category. This, you know, nobody, at least from what we understand by our competitors profitability profiles, there is nobody that starts with a profitability that's higher than ours. If then there would be a small player somewhere. But of the larger players, nobody has the luxury not to pass, I think, a large majority of these headwinds on to consumers.

(…) we have hedges that take us through the majority of next year, at least three quarters of next year, which also allows us then, first of all, come back to Lars' point, should we be introducing some other margin enhancing ideas. But importantly, it allows us to to force the other people to show their hand first, and then we can adjust our pricing policies accordingly when we understand where the market goes and how consumers respond to this.

The other point, of course, is on the tariffs. If you're US based only company, well, you either take it on the chin or you pass it on to consumers. (…) We could take that, and we could peanut butter that out on a global volume.

The slow pace of the jewelry market, where customers make purchases only a few times a year, means our efforts in materials, designs, and global expansion take a long time to show results. In contrast, the market challenges we've discussed are evolving much more quickly.

In the latter half of 2025, management has expressed concern about the deteriorating U.S. market, citing factors like rising unemployment and inflation. While this is expected to affect the entire jewelry sector, Pandora is positioned to likely gain market share. My personal concern is that even after an action plan is implemented for the Italian market, it won't see a turnaround. If this saturated market follows a similar decline to China, the argument that China was an exceptional case will no longer be valid. Then the brand equity and terminal value of the company will be at risk of deteriorating from one day to another, a reason that would lead me to sell the stock.

This has been a very extensive earnings review, and that's not surprising given the drop in the stock price last Friday, as well as the amount of information and updates provided by the company.

The valuation and investment case, therefore, deserve a separate chapter that will follow this earnings review in the coming weeks.

Hope you enjoyed this earning review of Pandora. So please leave a comment, give it a like and share!

If you would like to receive new posts and support this type of content… do not hesitate, subscribe!

Reply