- The Octopus Value Investing

- Posts

- #4 Investment Sidebar Snapshots

#4 Investment Sidebar Snapshots

September 2025 News & Insights Recap

Hi everyone,

Welcome to the fourth installment of Investment Sidebar Snapshots! In this edition, I’m excited to share a curated collection of key news and business insights I gathered throughout this month. My goal is to provide you with valuable, concise updates to keep you informed and ahead in the dynamic world of investments.

DISCLAIMER: This article is not a recommendation to buy or sell any financial instrument, the content is educational and my personal opinion. Each person has to make his own analysis. Any action or decision you take as a result of viewing this article is your sole responsibility.

Support Independent Analysis

This newsletter will always be FREE! If you’d like to help sustaining it, consider buying me a coffee. With your contribution I will cover any annual costs I might incur and search for alternatives to enhance the experience.

Executive Summary

Novo Nordisk $NVO ( ▼ 0.28% ) Restructuring Plan

New Data on Semaglutide Pill for Obesity

Update on Compounding Situation

Pharma Glass Packaging Remarks

Novo Nordisk $NVO ( ▼ 0.28% ) Restructuring Plan

On Wednesday 10th of September, Novo Nordisk announced its workforce restructuring plan.

The plan consists on reducing the global workforce by 11.5%, cutting 9000 jobs (being 5000 alone in Denmark) out of total 78500.

This restructuring plan will be negotiated until end of the year and it is expected to encompass DKK 8 billion net one-off expense due to restructuring costs.

Management estimates that DKK 8 billion will be saved every year.

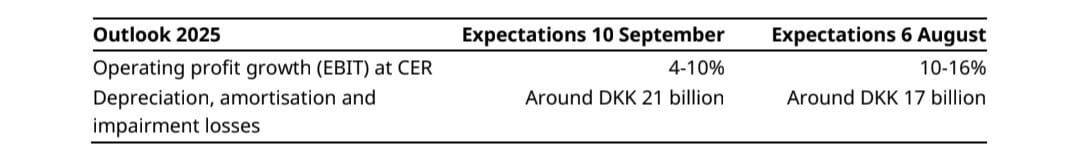

The guidance for FY25 was updated once again to reflect the revised expectations as shows in the image below.

Figure 1: Novo Nordisk updated guidance reflecting restructuring plan costs.

Additionally, on Thursday 11th of September the company also announced its announced its new 5-days at the office work policy.

This policy still allows for employees to discuss and agree with their manager their own work arrangement.

Considering the timing of this return-to-the-office policy and how deeply enrooted at work in Hovedstaden area in Denmark values such trust, autonomy and flexibility are I believe this policy is part of a “quiet firing” strategy.

Quiet firing is defined as the practice of creating a negative or unsupportive work environment to indirectly pressure employees into quitting, rather than firing them formally. This approach allows employers to avoid the financial costs, legal issues, and awkwardness associated with traditional terminations.

I am on the opinion that massive hiring previously damaged Novo Nordisk work culture by introducing employees who didn't align with their values. Hence, I think that it's a mistake to now prioritize saving a fraction of restructuring costs at the expense of further negatively impact the company culture again.

I'm this regards I held a very insightful discussion with Fredrik Kjell, COO of Truecaller $TRUBF ( ▼ 39.49% ) , on X. He argues that returning to office work is completely normal and that it will reinforce the culture as teams will be closer together. See our conversation in the thread below 👇

Today $NVO announced its new 5-days at the office work policy 😬

This directly clashes with the Nordic flexible and autonomous work culture.

More concerning than layoffs for the culture in my opinion.

— The Octopus Investing (@SiemprePulpo)

5:17 PM • Sep 11, 2025

New Data on Semaglutide Pill for Obesity

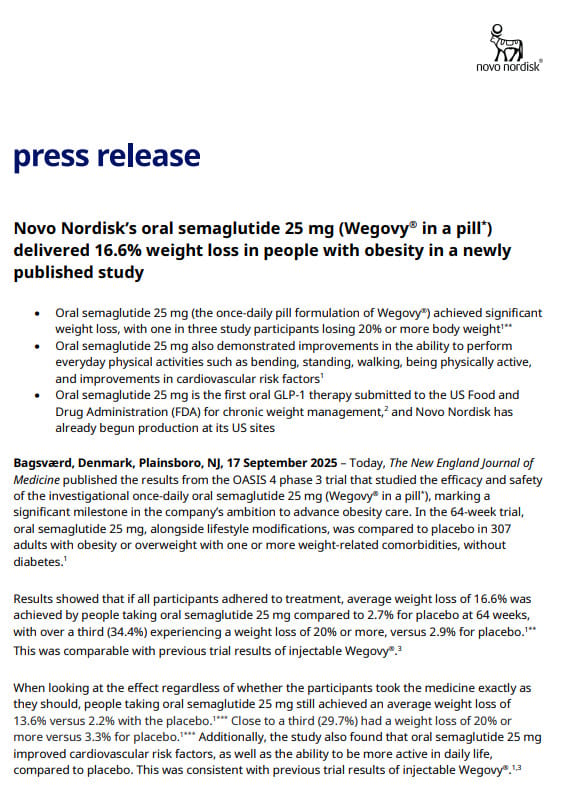

On the 17th of September, Novo Nordisk through the New England Journal of Medicine, NEJM, released new data of their semaglutide obesity pill after OASIS 4 phase III 64-weeks clinical trial was completed.

Oral semaglutide 25 mg has demonstrated an impressive 16.6% average weight loss in phase III clinical trials, with a third of the participants achieving over 20% weight loss. Benefits regarding cardiovascular protection and improved physical performance were also observed during the trial.

Figure 2: Novo Nordisk press release of OASIS 4 trial results.

In contrast, orforglipron, developed by Eli Lilly, emerges as a competitive non-peptide oral GLP-1 receptor agonist, with trials showing a 10-11.2% weight loss at 36 mg daily, as per the New England Journal of Medicine’s 2025 report on its phase III trials. Orforglipron’s advantage lies in its smaller molecular structure, potentially simplifying production and reducing costs.

Novo Nordisk and Eli Lilly are racing to land an effective oral obesity treatment, a segment that might seem less cost-effective but that brings other benefits to patients such as eliminating the burden of transitioning from taking no medication to self-inject them on a daily/weekly basis, eliminates the need for refrigeration and simplifies travel logistics.

As per current data, Novo Nordisk is ahead on efficacy, adherence, additional supporting evidence, economies of scale & required manufacturing capacity and time-to-market while they are on par regarding safety profile and lagging behind on manufacturing complexity.

Update on Compounding Situation

Two big announcements regarding compounding were announced during the first half of September:

FDA created a “green list” of overseas compounding suppliers

The U.S. Food and Drug Administration (FDA) has launched a "green list" initiative to regulate the import of GLP-1 active pharmaceutical ingredients (APIs), approving only those from inspected facilities meeting stringent manufacturing standards. This aims to block potentially unsafe APIs from unverified foreign sources.

Today, the FDA established a “green list” import alert to help stop potentially dangerous GLP-1 active pharmaceutical ingredients from unverified foreign sources from entering the U.S. market.

The agency will continue to work with state regulators, monitor the market, and— U.S. FDA (@US_FDA)

6:46 PM • Sep 5, 2025

Some analysts suggest this could create a "grey" compounding market, potentially threatening the long-term growth of branded GLP-1 drug makers like Novo Nordisk and Eli Lilly. I argue that this news is slightly positive as they limit the entrance of cheap foreign GLP-1 API into the USA because it hits compounding pharmacies supply chains and margins (manufacturing those APIs in the USA will be more expensive).

Additionally, a potential shift of Indian and Chinese API manufacturers toward supplying local markets with generic semaglutide could disrupt U.S. compounding pharmacies' supply chains and margins.

Mass compounding, which spiked during the semaglutide shortage resolved in Q1 2025, may have impacted branded drug sales more than the green list itself. While compounding remains legal, the FDA's response to unfair practices could shape the GLP-1 market's future. Current FDA statements do not appear to support such practices, leaving room for further regulatory developments.

Hims & Hers $HIMS ( ▼ 2.64% ) was called out for mislabeling by the FDA

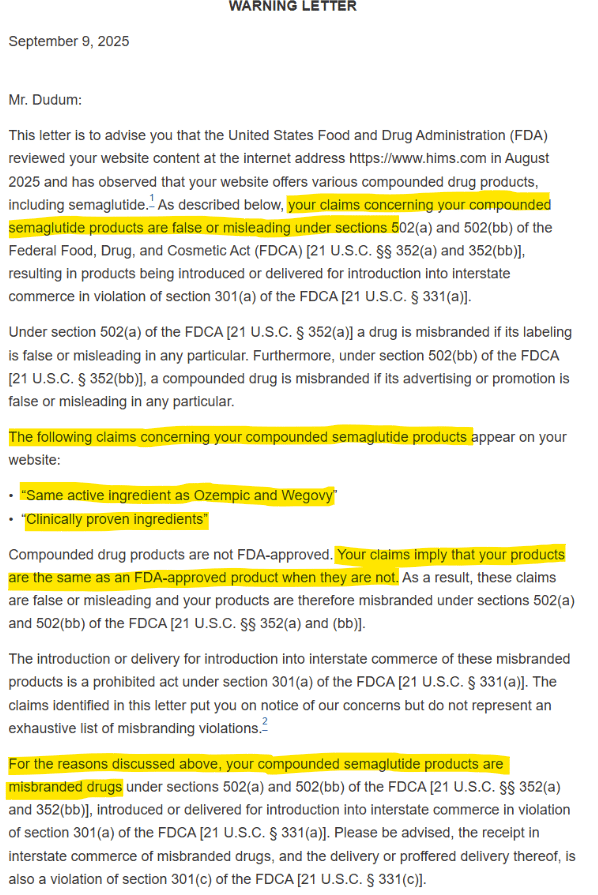

On the 9th of September the FDA issued warning letters to Hims & Hers regarding misleading claims regarding their compounded semaglutide medications and the misbranding of them.

FDA literally states in the letter “Your claims imply that your products are the same as an FDA-approved product when they are not”. See figure 3 below:

Figure 3: FDA letter page 1 to Hims & Hers regarding compounded drugs misbranding.

I believe this two developments plus some positive advancement that might come in relation with the legal ongoing procedures against compounders open the path to further countermeasures against the mass compounding scam occurring in the USA.

Pharma Glass Packaging Remarks

Gross margin gap between bulk and ready-to-use packaging

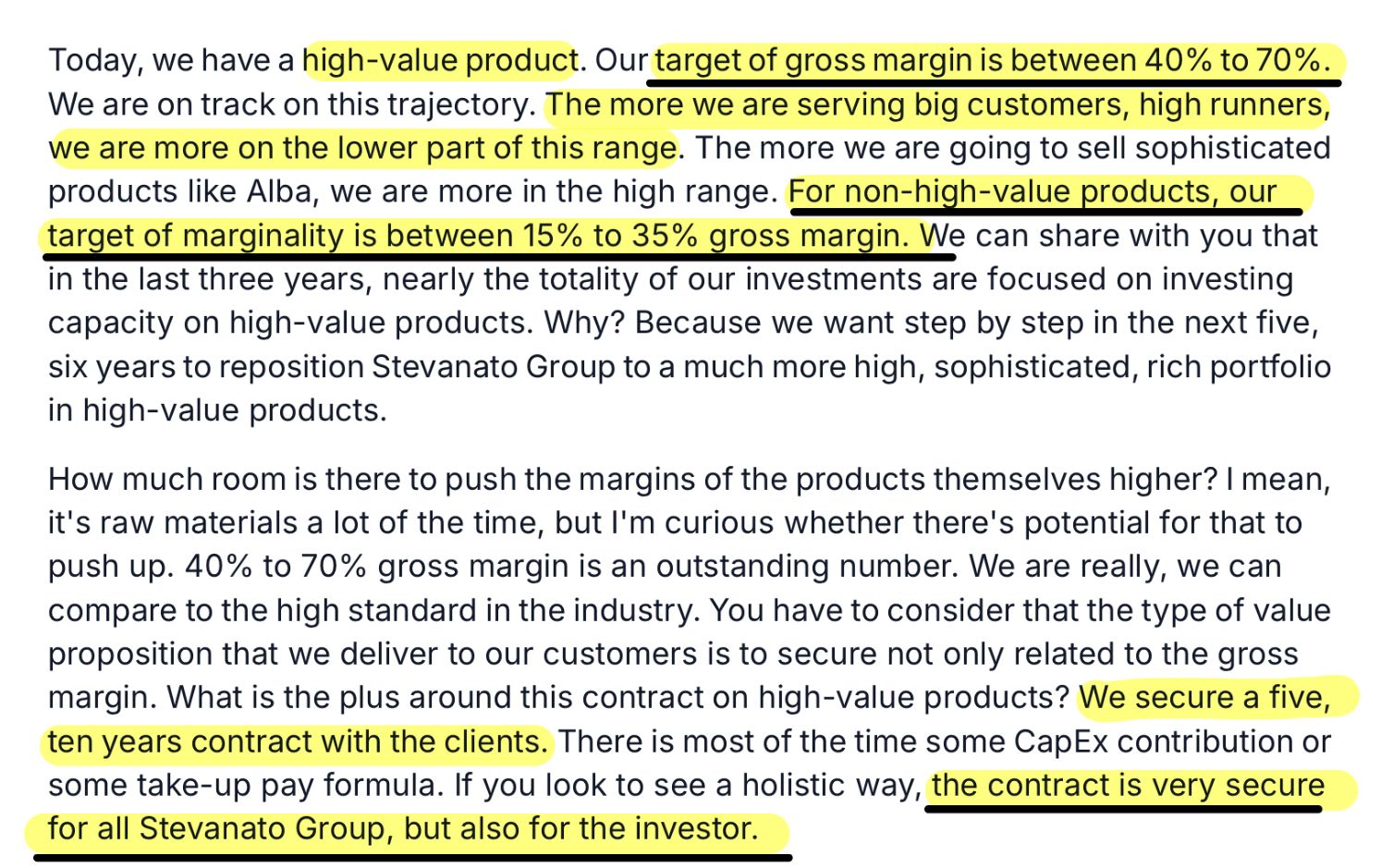

@Investquotes shared on X a very insightful extract from a recent conference in which Stevanato Group $STVN ( ▲ 1.69% ) , the other major pharma glass packaging manufacturer together with Schott Pharma, breakdown the gross margin gap between bulk and high-value products.

According to Stevanato, bulk products have a gross margin of 15-35% while high-value ones gross margin is on the 40-70% range.

Figure 4: Extract from $STVN ( ▲ 1.69% ) conference shared by @Investquotes.

Generic semaglutide impact on pharma glass packaging

In 2026, semaglutide is getting off-patent in some large markets such as Canada, Brazil and China. In that regard, last month IQVIA published Off-patent semaglutide in 2026: the next revolution in anti-obesity medications, an article discussing off-patent semaglutide implications in the GLP-1 market for diabetes and obesity.

There was a sentence in that article that caught me eye but for a different reason, it was exposing a second grade potential implication of generic semaglutide in the pharma glass packaging demand. Currently, generic pharma companies are already experiencing low availability of injection pens. Hence, it generic GLP-1 treatments gain popularity we could see a strong demand surge as more patients will be able to afford the treatments.

Figure 5: Extract from Off-patent semaglutide in 2026: the next revolution in anti-obesity medications, IQVIA.

Hope you enjoyed September´s Investment Sidebar Snapshots newsletter. Don´t forget to let me know in the comments if you like this type of newsletters!

If you found today's insights helpful, please share them with a friend or colleague. It really helps the newsletter keep moving forward.

Stay Always Tuned!

Subscribe now and join a community of savvy investors. Receive the latest insights directly in your inbox each week, ensuring you never miss a valuable opportunity.

Reply