- The Octopus Value Investing

- Posts

- #3 Investment Sidebar Snapshots

#3 Investment Sidebar Snapshots

Monlunabant, Novo Nordisk & Lesson from 10 Years of US Biosimilars Market

Third installment of Investment Sidebar Snapshots. This time it's not an update on the latest news from Novo Nordisk, although the newsletter is mainly focused on different aspects of the company as the lessons from the biosimilar market can be applied to what may happen with GLP-1 drugs in the coming decade.

DISCLAIMER: This article is not a recommendation to buy or sell any financial instrument, the content is educational and my personal opinion. Each person has to make his own analysis. Any action or decision you take as a result of viewing this article is your sole responsibility.

Support Independent Analysis

This newsletter will always be FREE! If you’d like to help sustaining it, consider buying me a coffee. With your contribution I will cover any annual costs I might incur and search for alternatives to enhance the experience.

Executive Summary

Novo Nordisk Monlunabant Review by @Lab_Inversion

Wegovy Label Extension

Novo Nordisk Workforce Cost Control Measures

10 Years of US Biosimilars Market

Novo Nordisk Monlunabant Review by @Lab_Inversion

@Lab_Inversion made earlier this week the most in depth review of Monlunabant (INV-202), one of Novo Nordisk’s assets in the R&D obesity portfolio.

Monlunabant is one of the assets Novo Nordisk got from acquiring Inversago Pharma. Back in March 2024, Novo Nordisk announced during its capital markets day that the drug could achieve 15% weight loss soyou might remember it better by its disappointing clinical trials phase 2a in September 2024.

Monlunabant is an oral cannabinoid receptor 1 (CB1) inverse agonist, targeting weight loss in people with obesity and metabolic syndrome (MAFLD/MASH). In the 00’s, rinmonabant (developed by Sanofi) used the same mechanism and had to be discontinued after approval due to safety concerns.

If you want to dive deeper into this asset, just check @Lab_Inversion work below 👇

Hoy dejamos de lado la plataforma de péptidos de Novo Nordisk $NVO para evaluar Monlunabant, una apuesta diferente de la compañía danesa para combatir la obesidad. Veamos por qué creo que este compuesto decepcionará.

Al lío 🧵— Gonzalo (@Lab_Inversion)

7:56 AM • Aug 17, 2025

Wegovy Label Extension

On Friday 15th of August, the FDA has approved a new indication for Wegovy, the treatment of MASH (metabolic dysfunction-associated steatohepatitis) in adults with moderate to advanced fibrosis. Last year I wrote full newsletter uncovering the metabolic diseases vertical potential focusing on MASH.

In the ESSENCE trial, 36.8% of patients treated with Wegovy saw an improvement in their liver fibrosis without worsening inflammation, compared to 22.4% on a placebo. Additionally, 62.9% achieved resolution of steatohepatitis without worsening fibrosis, versus 34.3% in the placebo group.

Wegovy is the first and only GLP-1 approved for MASH, and the second drug approved fro MASH after Rezdiffra (Resmeritron API) approval in March 2024.

This adds around 33 million non-obese patients to Novo Nordisk’s total addressable market (TAM).

Figure 1: Relative prevalence of metabolic dysfunction across obese and non-obese USA segments of population. Source: Attia P., Gifford B.; (2023); Outlive. The Science of Longevity.

Novo Nordisk Workforce Cost Control Measures

During the week there have been rumours on the press regarding Novo Nordisk $NVO implementing cost control measurements focused on their employees:

Huge layoffs.

Employees yearly bonus cut.

Hiring freeze for non-business critical roles.

Given our hyper-growth over the past three years, I believe we need to become a leaner organization. A reorganization and targeted layoffs will create a strong foundation for sustainable growth. Moreover, if business objectives are not achieved I support performance bonus not being granted. However, and based on the numbers, I don't see cost control as a problem for Novo Nordisk. Employee costs have consistently been 25-30% of sales since 2018, and the company has maintained an operating margin of over 40%.

Figure 2: Novo Nordisk various headcount metrics compiled. Source: Own elaboration based on annual reports data from note 2.4.

Moreover, annual reports data show that revenue compounded growth has been +17.12% since 2018, far outpacing the employees costs:

Employees headcount: +9.4% CAGR since 2018.

Employees total costs: +13.5% CAGR since 2018.

Total cost per employee: +3.6% CAGR since 2018.

Revenue per employee: +7.2% CAGR since 2018.

Total employees costs-Sales ratio: +500 bps vs 2018.

If we repeat the calculation for the three year hyper-growth period from 2021 to 2024 the numbers just get better.

Figure 3: Data visualization from table presented in figure 2. Source: Own elaboration.

Figure 4: Data visualization from table presented in figure 2. Source: Own elaboration.

I support striving for a leaner organization but having looked into the numbers, the cost control measurements on the workforce doesn´t seem to me the right place to focus right now. I believe this has two explanations:

Cancellation of long-shot R&D programmes to prioritize and focus in key molecule candidates will lead to a reduction of the workforce in related areas.

Narrative control: New management showing on the FY25 results how successful the turnover is being, supporting the management change.

Lessons from 10 Years of US Biosimilars Market

On the 9th of July, an article reviewing last decade US biosimilars market was published in the prestigious, British scientific journal, Nature.

The article provides an overview on how the biosimilars adoption has evolved during the last 10 years, searching for answers about how will it develop in the years ahead. Link to the full article below.

Personally, I find very valuable to uderstand what challenges faces the adoption of biosimilars to understand how can the GLP-1 market could develop as semaglutide patents expiry in some countries (Canada & China) in 2026 and in the early years of the coming decade in the US.

Let’s start with some facts about biosimilars adoption IN THE us:

Biosimilar versions for 14 products have been launched since 2015.

US healthcare system has saved US$36 billion through prescribing biosimilars ($12.4 billion in savings in 2023 alone).

Only 50 biosimilars out of 75 US FDA approved have been commercially launched in the US market.

Factors Affecting Biosimilars Adoption

Companies developing biosimilars have faced substantial legal and financial hurdles in bringing products to market, including extensive patent thickets established by companies that developed the original biologics (known as originator or reference products) and challenges in gaining formulary access.

The US launch in 2023 of biosimilar versions of AbbVie’s TNF-targeted monoclonal antibody (mAb) Humira (adalimumab), best-selling drug in the world in 2022, has signalled a major shift in the competitive landscape, with expectations for broader access, reduced healthcare costs and increased market adoption of biosimilars.

Regulatory policies facilitating biosimilars adoption.

In 2024, the FDA’s draft guidance in interchangeability proposed the elimination of switching studies, allowing biosimilars manufacturers to demonstrate interchangeability through a statement based on comparative analytical and clinical data in the drug’s original Biologics License Application (BLA).

In 2022, the Inflation Reduction Act (IRA) created incentives for biosimilar utilization by: 1. Capping the out-of-pocket threshold at $2,000 for beneficiaries of Medicare Part D. Without these regulations, switching to biosimilars would not be financially beneficial for older adults (65+ years), as originator manufacturers tend to provide co-pay assistance, which encourages patients to continue using branded products rather than switching to lower-cost biosimilar versions; 2. Increasing rebates value providers get from 6% to 8% for choosing biosimilars which offer a lower average selling price (ASP) than the branded reference product.

Originator company tactics dampening biosimilars adoption.

Despite these policy changes, not all biosimilars have achieved substantial market penetration, as shown in Fig. 1. To gain preferred formulary access, biosimilar manufacturers typically need to offer discounts in the range of 25–30% below the reference product’s net price. However, despite the lower net price of biosimilars, payers’ contractual obligations with manufacturers of originator products do not allow formulary adjustments to apply universally across all plans. For instance, Humira is a specialty-tier drug where patients would pay co-insurance of at least 20% of a high list price of over $6,000 per month. In response to biosimilar competition, AbbVie reduced the net price levels to below $1,000, which now makes Humira eligible to be placed in non-preferred tier-3 brand, for which patients make a fixed co-payment (for example, $50–$100 per month). This strategy to enable fixed patient co-payments rather than high specialty-tier co-insurance effectively diminished the out-of-pocket cost advantage that biosimilar competitors offer and retained patients on Humira, which still has the brand loyalty and prescriber familiarity advantage. Therefore, AbbVie has continued to preserve meaningful market share for Humira through aggressive long-term contracting and discounting Humira, with rebates 60–85% below its wholesale acquisition cost (WAC). Furthermore, AbbVie has strategically used its wider immunology portfolio, including Skyrizi (risankizumab) and Rinvoq (upadacitinib), as part of its contracting efforts to fortify and defend the market position of Humira.

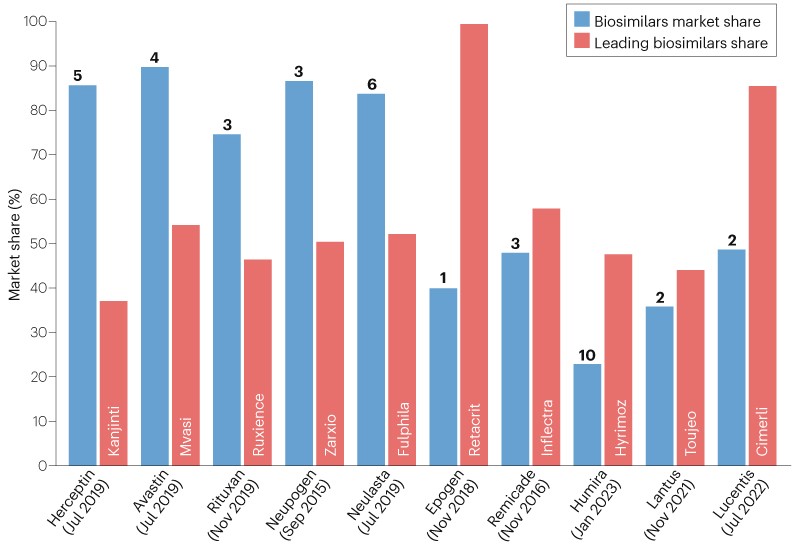

Figure 1: Market penetration of biosimilars in the United States. The ten reference drugs shown had biosimilars commercially launched by December 2023 and had the top biosimilar market share in 2024. The market share in Q4 2024 of all biosimilars of the given reference originator product is shown by blue bars. The numbers at the top of the blue bars represent the number of biosimilars launched for the reference product. Orange bars represent the percentage of the biosimilars market share acquired by the leading biosimilar for each reference product. The month and year in brackets next to the reference drug name represents the launch date of the first biosimilar version in the US market.

Emergence of a dual-WAC strategy and private-label biosimilars.

Originator biologic manufacturers have strategically introduced unbranded versions of their drugs to maintain formulary access with payers to protect the originator’s market share and limit the adoption of biosimilars. A key component of this tactic is the offering of two WAC (Wholesale Acquisition Cost) options for the unbranded versions: one with a high WAC (5% less than the branded originator), offering a high rebate and appealing to pharmacy benefit managers (PBMs), and one with a low WAC (80% less than the branded originator), offering a low rebate and suiting health plans that have higher deductibles.

The three major PBMs are focusing on collaborating with a single manufacturer to develop co-branded products, especially for biosimilars that are reimbursed via pharmacy benefit, for which the associated out-of-pocket costs are immediately applied towards the deductible and maximum out-of-pocket costs.

Biosimilars pipeline and outlook

The US biosimilars market is set for substantial growth and diversification as several high-value biologics are approaching patent expiration in 2025 and 2026, opening the way to biosimilar launches.

Between 2025 and 2029, 60 biologics are set to lose patent protection. Table 1 lists biologics that have biosimilars in late phases of development, the majority of which had sales in the US of >$2.5 billion in 2024. There is thus a notable gap in the development of biosimilars for lower-value biologics, which represents a missed opportunity for healthcare savings.

Table 1: Leading branded biologics in line to face biosimilar competition.

Reference drug | Originator company | Molecule | Therapeutic area | US patent expiry |

|---|---|---|---|---|

Soliris | AstraZeneca | Eculizumab | Immunology | 2021 |

Tysabri | Biogen | Natalizumab | Neurology | 2024 |

Xolaira | Genentech | Omalizumab | Respiratory | 2025 |

Humalog | Eli Lilly | Insulin lispro | Diabetes | 2025 |

Perjeta | Roche | Pertuzumab | Oncology | 2025 |

Simponi | Janssen Biotech | Golimumab | Immunology | 2025 |

Entyvioa | Takeda | Vedolizumab | Immunology | 2027 |

Trulicitya | Eli Lilly | Dulaglutide | Diabetes | 2027 |

Orenciaa | Bristol Myers Squibb | Abatacept | Immunology | 2028 |

Opdivoa | Bristol Myers Squibb | Nivolumab | Oncology | 2028 |

Keytrudaa | Merck | Pembrolizumab | Oncology | 2028 |

Ocrevusa | Roche | Ocrelizumab | Neurology | 2029 |

Repathaa | Amgen | Evolocumab | Cardiovascular | 2029 |

Enbrela,b | Amgen | Etanercept | Immunology | 2029 |

Cosentyxa | Novartis | Secukinumab | Immunology | 2029 |

Biosimilar versions of the biologics listed are in late-stage development. a High-value biologic with annual sales >$2.5 billion in the United States. b On the Medicare price negotiation list.

In the future, the introduction of private-label biosimilars through PBMs collaborating with manufacturers are expected to lead to markets where these biosimilars dominate over others in the race to capture the most value before newer treatments displace standards of care. This trend will be especially relevant for self-administered biologics that are covered through pharmacy benefit.

If this is especially relevant for self-administered bioligics, I expect the same would apply to self-administered peptides like Novo Nordisk’s semaglutide! Overall, off patent drugs are stickier than one might think at first sight. Moreover, PBMs favour their products and even cooperate with big pharma. Consequently, despite some initiatives favoring biosimilars adoption have been implemented in the past years as aboved described, original manufacturers still have a whole playbook to stay ahead of cheaper competitors.

Hope you enjoyed this first post of the Investment Sidebar Snapshots. Don´t forget to let me know in the comments if you like this type of newsletters!

If you found today's insights helpful, please share them with a friend or colleague. It really helps the newsletter keep moving forward.

Stay Always Tuned!

Subscribe now and join a community of savvy investors. Receive the latest insights directly in your inbox each week, ensuring you never miss a valuable opportunity.

Reply